������������

Who are the top 10 pharmaceutical companies in the world? (2024)

The pharmaceutical industry continues to generate stellar growth and was in 2023.

Despite disruptions caused by the Covid-19 pandemic in recent years and rising research and development costs globally, pharmaceutical companies have remained agile. New medications are constantly being developed, approved and marketed, powering market growth.

THE PHARMACEUTICAL MARKET IN 2023

In 2023, by the FDA, the second-highest count in the past 30 years. This cohort was nearly double what it was in 2022, which is likely to be because of issues such as workflow disruptions and bandwidth problems caused by the global Covid-19 pandemic have improved.

Several drug patents expired in 2023, including AbbVie’s Humira and Johnson & Johnson’s Stelara. Looking ahead to 2024 and beyond, the pharma industry is set to face further shake-ups in the coming years with many more blockbuster drugs from Bristol Myers Squibb, Novartis and other companies are set to face their first generic or biosimilar competitors in the largest global pharma market, the US. As always, the patent expirations should create quite a disturbance for many of the top players.

Mergers and acquisitions (M&A) are also gradually changing the marketplace and some of the largest drugmakers have been strengthened through joining forces with or being bought out by other businesses. According to GlobalData’s Deals Database, in the global pharmaceutical industry, there were worth a total value of $68.8bn. There are not expected to be any megadeals that combine large conglomerates this year, but large pharma companies will likely continue to pursue with acquiring or partnering with biotechs to offset losses from patent expires.

The below list of the top 10 biggest pharma companies in the world in 2024 is ranked by 2023 revenue for pharmaceutical sales only.

THE TOP 10 PHARMACEUTICAL COMPANIES IN THE WORLD IN 2024

10. GSK US$38.4bn (+6%)

GlaxoSmithKline, commonly known as GSK, remains in tenth place in 2024. Formed by the merger of Glaxo Wellcome plc and SmithKline Beecham plc in 2000, GSK specialises in the fields of pharmaceuticals, biologics, and vaccines.

In July 2022, GSK completed the demerger of the Consumer Healthcare business from the GSK Group to form the Haleon Group. They cut ties completely in early 2024, when they announced they had divested approximately 385 million ordinary shares in Haleon. Two years on, the demerger has already started to pay dividends, allowing GSK to focus purely on biopharmaceuticals, prioritising investment towards the development of innovative vaccines and medicines. In the full year 2023, , with sales up by 6%, with the clear highlight being the . Tipped to be a blockbuster and approved by the FDA in 2023, Arexvy is the world’s first respiratory syncytial virus vaccine for older adults. Elsewhere the company continued to progress their pipeline and has at least 12 major launches planned before 2025, with new vaccines and speciality medicines for infectious diseases, HIV, respiratory and oncology.

At the end of H1 2023, , further adding to their portfolio, in February 2024 they announced they were bolstering their existing asthma business. With continued momentum, CEO, Emma Walmsley is confident in their ability to deliver meaningful growth in 2024 and announced their plans to upgrade their growth outlooks for 2026 and 2031.

9. Bristol-Myers Squibb US$45bn (-3%)

In ninth place in 2024 is global biopharma, Bristol-Myers Squibb (BMS). With a legacy in healthcare innovation dating back to the early 1800s, the company has made significant medical advances in oncology, hematology, immunology and cardiovascular disease.

Full year 2023, BMS generated revenues of $45bn, a decrease of 3% compared to 2022, when sales reached US$46.2bn. A fall in income is largely owing to the loss of exclusivity for multiple myeloma treatment, Revlimid, but partially offset by higher sales for their new product portfolio and blockbuster advanced stage lung cancer treatment, Opdivo (+9%).

In the , CEO, Christopher Boerner commented “In 2024, our focus is on delivering strong commercial execution and accelerating opportunities that enhance our growth profile in the middle of the decade and beyond”.

8. Novartis US$45.4bn (+8%)

After being in the top 5 in 2023, in 2024 Swiss multinational pharmaceutical company, Novartis, comes in at number 8. For over a quarter of a millennium, Novartis has developed, manufactured and marketed breakthrough medicines.

With the spin-off of Sandoz and the biosimilars division, the merger of their Oncology and Pharmaceuticals commercial organisations, for Novartis 2023 was about transforming into a “pure-play” innovative medicines business. The company reported that their net sales reached US$45.4 billion up 8% and 10% at constant currencies. Blood clot treatment, Eliquis, was the star of the show with worldwide sales increasing by 4%, driven by higher demand in the US. Opdivo (nivolumab), a prescription drug for advanced stage lung cancer, also drove a strong performance, helped by higher demand and new indications.

In the confirmed that they will continue to focus on four core therapeutic areas: cardiovascular-renal-metabolic, immunology, neuroscience and oncology. They have well developed pipelines in each area that will address disease burden and have high growth potential. Geographically, they plan to prioritise growth in the US, China, Germany and Japan.

7. AstraZeneca US$45.8 billion (+3%)

Headquartered in Cambridge, UK, AstraZeneca specialises in providing solutions for major disease areas, including oncology, cardiovascular, gastrointestinal, infection, neuroscience, respiratory and inflammation.

To strengthen their rare disease portfolio, AstraZeneca acquired American pharma, Alexion in 2021. Since then, AstraZeneca has demonstrated strong growth and for full year 2023, revenues rose by 3% driven by a solid performance for all key medicines and regions.

In December 2023, AstraZeneca entered into an agreement to acquire Icosavax, Inc (Icosavax). The acquisition strengthens AstraZeneca’s late-stage pipeline. To further embellish their portfolio, at the end of 2023, the company entered into a definitive agreement to acquire Gracell Biotechnologies Inc, a global clinical-stage biopharmaceutical company developing innovative treatments for cancer and autoimmune diseases, enriching the company’s growing pipeline of cell therapies.

In light of the , Pascal Soriot, CEO for AstraZeneca said, “As AstraZeneca celebrates its 25th anniversary, we are pleased to report another year of strong financial performance and scientific progress, with double-digit earnings growth, and investment in exciting areas of science, including antibody drug conjugates and cell therapies, that lay the foundations for long-term success. We expect another year of strong growth in 2024, driven by continued adoption of our medicines across geographies. Our differentiated and growing portfolio of approved medicines, global reach and rich R&D pipeline give us confidence that we will continue to deliver industry-leading growth".

6. Sanofi $46.2 (+2%)

Sanofi provides healthcare solutions to over 100 countries worldwide and has three core focuses: speciality care, vaccines, and general medicines. Over the last half century, Sanofi has grown into one of the world’s leading healthcare companies and is the eighth largest pharmaceutical company in the world by revenue in 2024.

In 2023, Sanofi generated sales of €43bn (US$46.16bn) with growth up 2% year on year mainly driven by Dupixent, eczema treatment, and vaccines which benefited from the launch performance of Beyfortus (vaccine for Respiratory Syncytial Virus).

In a similar strategic move to GSK, in late 2023 Sanofi announced, as part of their play to win strategy, that they planned to business to focus on increasing investment in their prescription portfolio, this is expected to close in Q4 2024.

In line with this approach, at the end of 2023, the company signed a $140 million partnership with French tech company, Aqemia. Together, by leveraging Aqemia’s physics algorithms and generative artificial intelligence.

In the , CEO of Sanofi, Paul Hudson commented, “2023 was a turning-point year for Sanofi, paving the way for our scientific leadership in Immunology. Coupled with our AI at-scale ambitions, we go forward as a development-driven, tech-powered biopharma company committed to serving patients and accelerating growth”.

.

5. Roche US$49.9bn (-1%)

With over 128 years of history in medical innovation, Roche is at the forefront of oncology, immunology, infectious diseases, ophthalmology and neuroscience, and is split into two divisions: pharma and diagnostics.

The pharmaceutical segment continued to account for nearly three quarters of the company’s overall income, with , a slight decline from the previous year when sales reached CHF45.6bn. Oncology treatment, Phesgo, drove a steady performance (+2% to CHF1.1bn). Ophthalmology medication, approved by the FDA and EMA in 2022, Vabysmo gained momentous traction in 2023 up 85% to CFH2.4bn. This offset the sharp drop in demand and sales for Covid-19 products which also negatively impacted the diagnostics division.

Marking a steady performance in 2023 and looking to the future, Roche CEO, Thomas Schinecker commented “We also made good progress in both our pharma and diagnostics product pipeline. One recent highlight is inavolisib, an oral therapy investigated in phase III trials which showed a reduction of more than 50% in the risk of death or worsening disease for patients suffering from advanced, hardto-treat breast cancer. We look forward to bringing this medicine to patients as soon as possible. Our new partnerships and acquisitions address disease areas with high unmet needs, such as inflammatory bowel disease and cardiometabolic disease. We are well positioned for future growth”.

4. Merck & Co US$53.6bn (+3%)

Merck & Co remains in fourth place in 2024. With over 130 years in business, Merck is headquartered in New Jersey and focuses on pharmaceuticals, vaccines and animal health.

In 2023, thanks to sustained growth across oncology and vaccines. Over the last few years, Merck & Co has made their way up the ranks thanks to their blockbuster cancer immunotherapy, Keytruda. In 2023, Keytruda accounted for over 46% of the company’s pharmaceutical revenues, with sales reaching US$25bn (+19%). Increased sales for Gardasil HPV vaccine (+29%) and MMRV vaccines (+6%), also helped to boost Merck’s pharma division. Further growth in 2023 was partially offset by lower sales of Januvia and Janumet, down 23%, owing to increased generic competition and a decline for Pneumovax 23, pneumococcal vaccine.

As Keytruda, moves toward the loss of market exclusivity in 2028, Merck has had to look for new avenues for growth. In April 2023, Merck announced it would acquire Prometheus Biosciences and in 2024 they confirmed they would buy Harpoon Therapeutics for US$680mn, accelerating their growing presence in immunology.

Robert M. Davis, chairman and chief executive officer, Merck said “2023 was another very strong year for Merck. I am extremely pleased by the progress we’ve made to develop and deliver transformative therapies and vaccines that will help save and improve lives around the world. We reached more than 500 million people with our medicines last year alone, over half of which were donations, including through our program to treat river blindness,” said Robert M. Davis, chairman and chief executive officer, Merck. “We also made investments of approximately $30 billion in research and development in our ongoing effort to discover, develop and collaborate to propel the next generation of impactful innovations. As we move forward, I’m confident that our strong momentum will continue, underpinned by the unwavering dedication of our talented global team”.

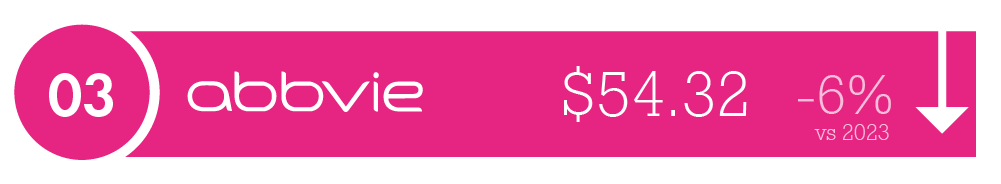

3. AbbVie US$54.3bn (-6%)

With over 50,000 employees spread over 70 countries, innovation-driven AbbVie secures it’s spot in the top 3. AbbVie was created in 2013, when the company separated from Abbott, and tends to drive its R&D efforts towards difficult-to-cure diseases. Seven years later in 2020, AbbVie successfully acquired Allergan, which has strengthened the company’s position in a number of therapeutic areas including immunology, oncology and neuroscience.

In 2023, sales totalled US$54.3bn, down 6% YOY owing to declines for immunology with the loss of exclusivity for arthritis drug, Humira and oncology with revenues for Imbruvica, which is now subject to the , decreasing by 19%. Although they are yet to see the true impact, AbbVie lost market exclusivity in the US for Humira, the company’s top drug and the bestselling non-covid product in biopharma history. Which means AbbVie must find other avenues for revenue and the company is hoping immunology duo Skyrizi (+50%) and Rinvoq (+64%) will be their next star performers.

In a press release announcing the company’s , Richard A. Gonzalez, chairman and chief executive officer, AbbVie commented "2023 was another outstanding year, marked by strong operational execution and significant overperformance from our non-Humira growth platform. During the year we meaningfully increased R&D investment and bolstered our pipeline with the proposed ImmunoGen and Cerevel Therapeutics acquisitions," he went on to add, "2024 is an exciting year for AbbVie, as we are well positioned to fully absorb Humira erosion and achieve modest operational revenue growth, followed by a return to robust growth in 2025 and a high single-digit CAGR through the end of the decade”.

2. Johnson & Johnson US$54.8 (+4%)

Johnson & Johnson, also referred to as J&J, leapfrogs AbbVie into second place in 2024. With headquarters based in New Jersey, Johnson & Johnson develops and produces pharmaceuticals, medical devices and consumer health goods.

For the company’s innovative medicine division, revenues increased by 4% on both a reported and operational basis in the full year of 2023. This was driven by a number of key performers, including Darzalex, a treatment of multiple myeloma, Stelara, a treatment of a number of immune-mediated inflammatory diseases, Tremfya, a plaque psoriasis and psoriatic arthritis treatment, Erleada, a prostate cancer drug and multiple myeloma medication, Teclistamab.

In an , Joaquin Duato, Chairman of the Board and Chief Executive Officer, said “. “Johnson & Johnson’s full year 2023 results reflect the breadth and competitiveness of our business and our relentless focus on delivering for patients,” he went on to say “We have entered 2024 from a position of strength, and I am confident in our ability to lead the next wave of health innovation”.

1. Pfizer - US$58.5bn (-42%)

American multinational pharmaceutical and biotechnology corporation, Pfizer remains in the top spot in 2024 for the third year in a row. Pfizer specialises in the development of medicines and vaccines across a wide range of disciplines including immunology, oncology, cardiology and neurology. Since the spin-off of Upjohn, which completed in 2020, the company has moved forward as a single focused innovative biopharmaceutical company, working on the discovery, development, manufacturing, marketing, sales and distribution of biopharmaceutical products worldwide.

In the fiscal year of 2023, , down 42% from 2022 where the company’s sales reached an impressive US$100bn thanks to its top-selling product Comirnaty, mRNA vaccine for Covid-19. Excluding contributions from its COVID portfolio, Pfizer achieved 7% operational revenue growth in 2023, with substantial contributions from new product and indication launches and growth from key brands.

Paving new ways for future growth, Pfizer worked to build a strong foundation for 2024 and beyond. In 2023, the FDA greenlit 9 New Molecular Entity approvals which is expected to greatly bolster Pfizer’s portfolio in the coming years. Furthermore, Pfizer completed the acquisition of Seagen Inc at the end of 2023, one of the largest investments in Pfizer’s history. The acquisition positions Pfizer to deliver the potential next generation of transformative cancer treatments.

David Denton, Chief Financial Officer and Executive Vice President, commented “We are pleased with the strong 8% operational revenue growth of Pfizer’s non-COVID products in the fourth quarter of 2023, achieving our full-year 2023 non-COVID operational revenue growth target of 6% to 8%,” he went on to say, “We are prepared to execute our commercial strategy to drive continued growth from our newly launched and acquired products, and to deliver on our targeted cost savings that we expect will expand our operating margins in 2024 and beyond”.

Is your pharmaceutical company aiming to grow this year?

At ������������ Staffing, we work with a number of leading global pharmacuetical companies. Our dedicated pharmaceutical recruitment team are specialists in sourcing skilled and experienced professionals to fill a wide variety of roles across all areas of the pharma industry, including biotech, genomics, vaccines, generics, biosimilars, and OTC medicines. Find out more about our range of workforce solutions and how we can help your business grow globally.

Interested in working for one of the top pharma companies?

At ������������ Staffing, we are specialists at recruiting for all types of pharmaceutical jobs. If you’re looking for a new position, simply use our job search tool to find the right role for you.

.png)

.png)

.png)

.png)

.png)

.png)