╠ņč─╔ńŪ°╣┘═°

Global Top 10 Animal Health Companies in 2024

Updated January 2025

The animal health industry encompasses a diverse range of solutions, spanning from disease prevention to meeting the ever-growing nutritional demands. With rising pet ownership and spending on animal healthcare rising, the demand for high-quality veterinary products and services has continued to grow,

The Animal Health Market in 2023

In 2023, the size and share of the worldwide animal health market was projected to be worth an impressive US$60.72 billion. According to the most recent analysis by , it is projected to create revenue of USD 149.02 billion by 2032, up by 10.5% on a compound annual growth rate basis. North America accounted for more than 40% of the market in 2023, but over the course of the projected period (2019 -2032), the Asia Pacific region is predicted to grow at the fastest Compound Annual Growth Rate (CAGR), while the veterinarian clinics and hospitals are predicted to have the fastest Compound Annual Growth Rate during the forecast period amongst all categories.

The below list of the top 10 global animal health companies in the world in 2024 is ranked by 2023 revenue for animal health sector sales only.

1. Zoetis (US$8.5 billion)

Established in 2013 through a spin-off from top pharma company Pfizer's animal health division, has quickly risen to prominence as a key player in the global animal health sector. The company provides vaccines, pharmaceuticals, diagnostics, and genetics designed for both livestock and companion animals. In 2023, the company revenues of US$8.5 billion, an increase of a steady 6% growth compared to 2022, driven by a stellar performance for their innovative companion animal portfolio which includes treatments for pain, dermatology and parasiticides.

In a recently ŌĆō the company revealed its acquisition of a 21-acre manufacturing facility in Melbourne. This purchase has also provided Zoetis with a third Australian manufacturing site. This move aims to substantially amplify its current operations and enhance future capacities for vaccine development and manufacturing across various animals, including sheep, cattle, dogs, cats, and horses. Presently, Australia produces 130 million doses of vaccines annually for both companion animals and livestock. In support of this, Zoetis will support the regionŌĆÖs livestock farmers in their journey towards becoming integral players in climate solutions.

2. Merck & Co (USD 5.6 billion)

Established in 1891, brings a legacy of excellence spanning across human and animal health sectors. With the companyŌĆÖs operations including vaccines for both livestock and companion animals, the company prioritizes efficacy, safety, and dependability. According to , their Animal Health divisionŌĆÖs revenue for 2023 reached US$ 5.6 billion, reflecting a flat 1% increase from 2022. Excluding the negative impact of currency fluctuations, sales growth was fuelled by heightened demand for livestock items, with poultry and swine products driving growth, although demand for ruminant products saw a slight decrease.

In February 2024, it was announced that an agreement had been reached to purchase the aqua business segment of Incorporated for $1.3 billion in cash. ŌĆ£We believe this acquisition, coupled with our commercial and scientific prowess, will deliver enhanced benefits for our aqua customers. The addition of this innovative portfolio of cold water and warm water aqua products across vaccines, anti-parasitic treatments, water supplements and nutrition, will establish Merck Animal Health as a leader in aqua.ŌĆØ said Rick DeLuca, president, Merck Animal Health.

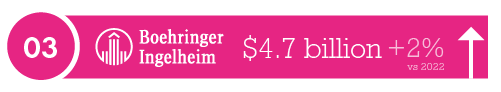

3. Boehringer Ingelheim (USD 4.7 Billion)

, based in Germany, is a prestigious pharmaceutical firm with a significant footprint in the Animal Vaccines Market. After opening their doors in 1885, the company has been providing a wide range of vaccines catering to livestock, pets, and poultry. Its focus lies in fighting respiratory diseases, infectious ailments, and reproductive disorders among animals.

In 2023, their animal health sector generated profits of US$ 4.7 billion, marking a steady 2% rise from the previous year's earnings. Their Animal Health division was also granted approval from both the U.S. FDA and the European Commission for SENVELGO, a ground-breaking oral treatment designed for . This represents a notable breakthrough in feline diabetes management, benefitting both cats and their owners. Cats diagnosed with diabetes will now have a greater opportunities to enjoy more fulfilling lives than ever before. Additionally, they introduced NexGard PLUS, an innovative oral combination providing parasite protection for dogs. ŌĆ£NexGard PLUS is the one veterinarians will want to help keep dogs protected from parasites. It offers internal and external parasite protection in a single monthly chew that dogs will enjoy, is backed by our clinic support team, and is the latest innovation in our trusted parasiticide portfolio,ŌĆØ said Whit Cothern, DVM, Executive Director of Veterinary Professional Services at Boehringer Ingelheim Animal Health.

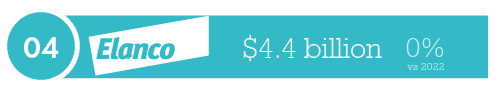

4. Elanco (US$4.4 billion)

is a global leader in animal health dedicated to offering medications and services aimed at supporting veterinarians and pet owners in extending the lives of their pets, promoting overall health and wellbeing. Additionally, the company assists farmers in enhancing animal health and welfare, fostering sustainable livestock practices for a healthier future. In 2023, their annual revenue remained steady at US$4.4 billion, mirroring the figures from the previous year.

Earlier this year Elanco a ground-breaking, multi-year initiative aimed at saving 1 million puppies from unnecessary deaths caused by the highly contagious canine parvovirus (parvo). Dr. Jennifer Miller, ElancoŌĆÖs Technical Veterinarian commented ŌĆ£Parvo doesnŌĆÖt have to be a death sentence. Our innovative treatment for parvovirus can help veterinarians and pet owners alleviate the emotional toll associated with parvoŌĆØ.

5. Idexx Laboratories (US$3.6 billion)

stands as a global frontrunner in veterinary diagnostics, software, and water microbiology testing. With an extensive range of diagnostic tests, instrumentation, and software solutions, IDEXX caters to veterinary professionals and livestock producers across more than 175 countries. According to a , the companyŌĆÖs annual revenue was $3.661 billion for 2023, reflecting an increase of 8.72% compared to 2022.

Earlier this year, the company the launch of IDEXX inVue Dx Cellular Analyzer, a pioneering slide-free cellular analyser designed to detect widespread cytologic changes in ear and blood samples. Equipped with advanced AI learning models and developed in collaboration with IDEXX board-certified pathologists, this in-clinic analyser delivers reference-laboratory quality results in just 10 minutes. Guillermo Couto, DVM, DACVIM (SAIM, Oncology), commented ,ŌĆ£For decades, practitioners like myself have struggled with the inadequacies of slide-based samples and now, with the IDEXX inVue Dx analyzer, the slide-free workflow is a game-changer backed by technology that provides the confidence we need to provide an accurate diagnosis for our patientsŌĆØ.

6. Virbac (US$1.35 billion)

Previously reported as $135.1 million in an error, now updated to $1.35 billion.

Established in 1968, the company has earned its strong reputation for its innovation and commitment to quality, driven by extensive research and development endeavours. dedication to animal welfare, sustainability initiatives, and collaborative partnerships with veterinarians distinguishes it within the industry, empowering the company to tackle emerging challenges and cater to diverse global markets effectively.

In 2023, the company had achieved revenues of Ōé¼1246.9 million ($1.35 billion). In the , Habib Ramdani CFO of Virbac group, stated; ŌĆ£For us, 2023 was a year of resilience. Despite the difficulties we faced, we were able to grow our revenue by approximately 5% and achieve a historic performance in our profitability before R&D.ŌĆØ Earlier this year, they successfully accomplished the acquisition of Sasaeah. This strategic move positions Virbac as a leader in the farm animal vaccines market in Japan, particularly in the cattle segment, and grants them access to an extensive portfolio of pharmaceutical products across all major species.

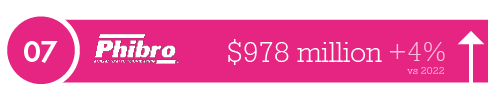

7. Phibro Animal Health Corporation (US$978 Million)

Founded in 1946, has established itself as one of the global leaders in animal health and nutrition. With a focus on vaccines, pharmaceuticals, nutritional supplements, and feed ingredients, Phibro provides a diverse portfolio aimed at optimizing animal health and productivity. In 2023 the company made which was saw a 4% profit increase compared to 2022, this was driven by strong growth in Animal Health and was offset partially by sales declines in both Mineral Nutrition and Performance Products.

In a , Phibro Animal Health Corporation announced an agreement, whereby Phibro Animal Health will acquire ZoetisŌĆÖ medicated feed additive (MFA) product portfolio, specific water-soluble products, and associated assets for US$350 million, pending customary closing adjustments. The acquired product portfolio, with a revenue of approximately US$400 million in 2023, encompasses over 37 product lines distributed across roughly 80 countries. Additionally, the agreement includes six manufacturing sites, comprising four in the U.S., one in Italy, and one in China. Jack C. Bendheim, Chairman, President and Chief Executive Officer of Phibro Animal Health said; ŌĆ£This investment will enhance, diversify and broaden our portfolio globally and help us continue to deliver value to our customers and to our shareholders. We believe our cash generation will allow for continued investment into our higher growth businesses of Nutritional Specialties, Companion Animal, and Vaccines. I am confident we have the right capabilities to integrate and strengthen this business. I look forward to collaborating with the Zoetis team and welcoming new colleagues to Phibro Animal Health to support this portfolio.ŌĆØ

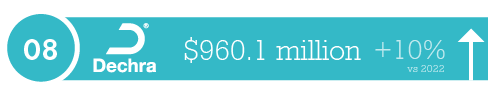

8. Dechra (US$960.1 million)

is a leading global authority in veterinary pharmaceuticals and associated products. Their focus lies in the development, manufacturing, marketing, and distribution of premium-quality offerings designed exclusively for veterinarians across the globe.

In the financial year of 2023, the company generated US$960.1 million in revenue. In the Chief Executive Officer, said; ŌĆ£Despite the wholesaler de-stocking being deeper and longer than we had initially anticipated, we saw consistently strong end customer demand for Dechra products throughout the year. Independent data for sales from wholesalers out to veterinary clinics showed sales growth of over 10% for the year as a whole and over 12% for the second half of the year despite the wholesaler disruption, offering reassurance that the de-stocking impact on our performance should be one-off in nature rather than a structural headwind.ŌĆØ

9. Vetoquinol (US$571 million)

a subsidiary of Soparfin SCA, specialises in veterinary pharmaceuticals, developing, manufacturing, and distributing medications and non-medicinal products for various animals, with a particular focus on cats, dogs, cattle, and pigs. The company's product range spans multiple therapy areas, including pain management, mobility, inflammation, dermatology, hygiene, udder health, anti-parasite solutions, antibiotics, reproduction, internal medicine, cardio-nephrology, and behaviour management.

Vetoquinol's sales for 2023 stood at US$571 million, remaining stable at constant exchange rates but experiencing a slight decrease of -2% on a reported basis compared to 2022 sales. In Matthieu Frechin, Chairman and CEO of Vetoquinol, commented: ŌĆ£In 2023, Essentials and the USA, our growth engines, recorded a tenth consecutive year of progression, thanks to a good 2nd half-year. This momentum has enabled us to deliver again a solid operating profitability in 2023, and to improve our cashflow generation. We intend to pursue this strategy with determination, intensifying the development of our Essentials portfolio and their territory extensions, particularly in the United States."

10. Hester Biosciences Limited (US$ 30.4 million)

Recognised for its dedication to innovation and devotion to global standards, provides comprehensive services such as targeting diseases such as (a contagious disease that affects birds including domestic poultry), avian influenza, and . Remarkable milestones include receiving accreditation by the World Organisation for Animal Health (OIE), underscoring its commitment to animal health and welfare. Recent advancements encompass the expansion of its product range and distribution network, reinforcing its status as a trusted authority in the animal vaccines market.

According to a , Hester reported US$30,419.57 Million in revenue for 2023, which was a 16% increase compared to 2022ŌĆÖs turnover. One of their include facilitating access to animal vaccines and healthcare products in Africa by bridging the gap between demand and supply.

In conclusion the global animal health industry is a vital contributor to both animal welfare and human health, providing essential products and services to safeguard against diseases and enhance productivity in livestock and companion animals. As we look ahead, the sector is expected to grow significantly, with projections indicating a substantial increase in market size and demand for high-quality veterinary products and services.

DO YOU NEED HELP HIRING FOR A HARD TO FILL VACANCY?

Our Animal Health recruitment specialists use the best-in-class applicant tracking system and industry-leading network tools enable us to help our partners find the right people for their specialist animal health teams.

INTERESTED IN WORKING FOR ONE OF THE TOP ANIMAL HEALTH COMPANIES?

At ╠ņč─╔ńŪ°╣┘═° Staffing, we are specialists at recruiting for all types of animal health jobs. If youŌĆÖre looking for a new position, simply use our job search tool to find the right role for you.

.png)

.png)

.png)

.png)

.png)